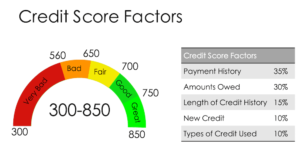

As we are dealing with these unprecedented and trying times, many people are being faced with great financial uncertainty. One of these concerns relates to protecting your credit score. Credit scores as well as credit reports are essential sources for tracking financial habits. These reports greatly impact any interest rates you pay as well as the amount of credit you can obtain. Due to the COVID-19 pandemic, people struggling with financial hardship and making payments might see their credit score or credit report suffer because of this.

Thankfully, due to new federal legislation, there will be new rules for obtaining credit reports for borrowers who are having difficulty paying their debts. The legislation that was passed via the CARES Act examines how credit obligations will appear on a credit report if a borrower seeks forbearance.

CARES Act Summary:

If you enter into forbearance or a payment modification program with any of your lenders, the lender must do the following when reporting your account to the credit bureaus:

- They must report the account or credit obligation as current; or

- If the account or credit obligation was delinquent before the accommodation, then they need to do the following:

-

- They must maintain the delinquent status during the period in which the accommodation went into effect; and

- If the borrower brings their account or credit obligation current within the 120 days since the CARES Act became law on March 27, 2020, then the lender must report the account or credit obligation as current.

Check Your Credit Score

Always make sure to check your credit report. If for any reason you find any mistakes on it, make sure to dispute those mistakes immediately. Under Federal Law, any person is entitled to one free credit report annually from each of the three agencies. You can review and request your free report online or by phone at 877.322.8228.

For additional information about credit reporting and credit reporting rights, visit the Consumer Financial Protection Bureau or the Federal Trade Commission.